Polygon Airdrops this week, the Ethereum blockchain had two errors, the second of which prevented finality from being reached for more than an hour. Aragon, a toolset protocol for decentralised autonomous organisations (DAOs), is involved in a conflict over treasury funds. Sandeep Nailwal, a co-founder of Polygon, also makes a final allusion to a future Polygon zkEVM airdrop(Polygon Airdrops), however DeFi users are still dubious.

An exciting week! Let’s look at what happened in DeFi over the past week.

Table of Contents

Overview: Markets Grind Lower, Alts Bleed

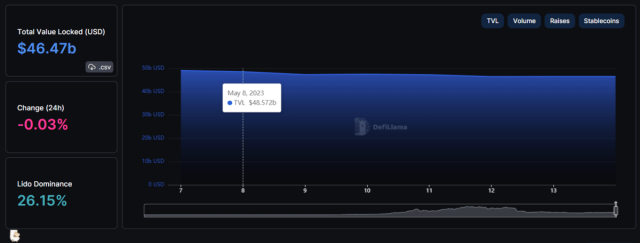

The total value locked (TVL) across all chains kept slipping lower as all cryptocurrency prices dropped. The BRC-20 narrative caused a spike in TVL for Bitcoin Layer-2 and Stacks, as well as increases in the low teens for Kava and Polygon zkEVM. The impending upgrade to Kava and rumours of a probable Polygon zkEVM airdrop are probably to blame for this.

Welcome to Alpha Central

José Maria Macedo agrees with the Delphi Labs’ Cosmos thesis and their positive outlook on the ecosystem. These factors include Noble’s provision of native USDC, the impending launches of Sei Network and dYdX’s version 4, among others.

The next development in the memecoin market, this time on the Bitcoin network, and BRC-20s, tokens created using the new BRC-20 token standard, are discussed in depth by Crypto Shiro.

Flashbots’ Bert Miller talked about how to avoid becoming a victim of the attacks by infamous sandwich attacker jaredfromsubway.eth and how much money he has been generating from memecoins.

Ethereum: Beacon Chain Stumbles

nearly the course of the week, the Ethereum Beacon Chain experienced two outages, failing to reach finality for nearly an hour and 25 minutes, respectively. Since then, the chain has been fully operational, and consensus clients Teku and Prysm have released updates to prevent future occurrences of the same problems.

MakerDAO, the creator of the DAI stablecoin, introduces the Spark Lend protocol, which permits borrowing and lending of ETH, DAI, and their staked derivatives, stETH and sDAI. The USA does not offer the service.

The following week, MakerDAO unveiled the “Endgame” protocol update, which will be the next significant one. The five-phase update will overhaul and modernise the DAI and MKR tokens as well as include AI technologies to increase the protocol’s effectiveness.

Launching on Ethereum, Avalanche, Arbitrum, and Moonbeam, Prime Protocol enables users to freely borrow against their entire cross-chain portfolio. Users who participate in the Early Adopter programme can presently receive points.

In response to an alleged 51% attempt by a group known as the Risk Free Value (RFV) Raiders, DAO tooling protocol Aragon reconfigured Aragon DAO treasury. They issued a revised statement to clarify their activities, indicating that while residual treasury assets will be distributed through a grants programme, DAO monies are not under the jurisdiction of the Aragon Association.

Avocado, the supported wallet for Instadapp’s account abstraction, has announced Avocado Multisig, adding multi-signature functionalities to the wallet. The ten supported chains will shortly all receive the feature.

Building bridges On the testnet of their zkRouter technology, a cross-chain bridge between Ethereum and Fantom, Multichain releases its first decentralised application (DApp). Zero-knowledge proofs (zk-proofs) serve as the foundation for the trustless and private asset transfer system known as ZkRouter.

Lido Finance, the leading ETH liquid staking derivative (LSD) protocol, is putting its Lido V2 update up for vote. If it is approved, the upgrade is scheduled to go live on May 15. The long-awaited withdrawal feature for ETH stakers will be included in Lido V2.

In addition to shielding users from assaults with a maximum extractable value (MEV), DeFiLlama also distributes MEV revenues to users when LlamaNodes are released. In association with MEV block creator NeoConstruction, LlamaNodes is created.

DeBridge, an interoperability layer, introduces its DLN API, enabling deep chain liquidity and promising almost instantaneous transactions with low fees.

Gravita Protocol, an ETH LSD-focused borrowing protocol, expands on some of its distinctive selling characteristics, such as support for numerous ETH LSDs and affordable borrowing costs for both short- and long-term borrowing.

Cashmere, a cross-chain MEV-protected swap protocol, has launched testnet v1.1 with improvements to transaction processing times and user interface. The Linea blockchain was also merged by Cashmere during the same week, bringing their total supported chains to 11.

A proposal to activate the Uniswap fee switch, which would direct a part of fees produced from pools to the Uniswap treasury, is created by blockchain research and development company GFX Labs. However, some users have voiced their scepticism, citing regulatory dangers, losing competitiveness to Uniswap V3 forks, and wasting a price catalyst in the current bearish conditions.

Hourglass goes live, offering a liquid staking layer for holdings in the Frax liquidity pool. Four alternative durations are now supported for frxETH-ETH liquidity pools.

L2s: DeusDAO Exploiter Returns Majority of Funds

The protocol receives 2023 ETH back from DeusDAO, the exploiter of the DEI stablecoin issuer. The total returned monies amount to about $6 million when combined with the funds that white hat hackers were able to successfully intercept, covering the majority of the losses.

Exotic peg hedging protocol Y2K Finance introduces their version 2, which will have automated rollovers, 24/7 deposit queues, more revenue streams for Y2K token lockers, and a larger variety of supported assets.

In order to preserve the capital of liquidity providers, the directional liquidity protocol PoolShark presents Cover Pools, a ground-breaking approach that permits stop-losses in positions within liquidity pools. Before going live on the mainnet, the functionality will initially debut on the testnet.

The platform now offers Ramses Concentrated Liquidity, a Solidly fork that combines concentrated liquidity and the Solidly bribes system to create a more effective approach. In the week beginning May 24, the feature is anticipated to go live.

Dopex, an arbitrum-based option vault protocol, introduces 0DTE (days-to-expiry) ARB option vaults, giving platform users who trade options access to short-term trading opportunities.

From 200K OP tokens last week, Synthetix will increase the trading rewards for perpetuals to 300K OP tokens. For the following 16 weeks, the awards will be raised, and front-ends based on Synthetix like Kwenta and Polynomial Finance will also receive additional rewards.

Users can now get protection from smart contract exploits, depegs, and other threats thanks to Cosy V2, a new version of the DeFi insurance protocol from Cosy Finance. By taking the other side of these insurance contracts, users can also profit by backing them.

Extra Finance, a leveraged yield-farming and lending protocol, is already operational on Optimism. The EXTRA token will be delivered in the upcoming weeks, according to the team, and an airdrop has been organised.

The StarkNet-deployed money market protocol, zkLend, enables the borrowing and lending of WBTC, ETH, USDC, USDT, and DAI.

Avalanche: GoGoPool Supports Subnet Deployment

GoGoPool, a permissionless staking mechanism, debuts on Avalanche, enabling quick subnet deployment at a fraction of the cost.

Cosmos: Neutron is Live

Launch of the Cosmos-based chain Neutron marks the beginning of the first live chain to use Replicated Security to be safeguarded by the Cosmos Hub. The Neutron airdrop will take place in the third week after launch to jump-start efforts at decentralisation and governance.

Levana Protocol, a perpetuals trade protocol, debuts on the Sei Network testnet of the finance-focused Cosmos chain and announces a series of missions for Sei testnet users in partnership with Blocked Protocol.

The Dymension modular blockchain network makes a clue about their planned testnet with incentives.

Another Week, Another Polygon Airdrops

Pika technology, a decentralised leveraged trading technology, announces a PIKA token sale in which only users who have been whitelisted will be allowed to participate. The token allocation for PIKA also includes 11% for retroactive and upcoming airdrops, however specifics have not yet been made public.

In response to arguments about the chain’s low TVL as a result of Polygon already having a circulating token, MATIC, the founder of Polygon suggests that a “massive airdrop” for Polygon zkEVM may be possible.

Users who were members of the Sui’s Discord server prior to May 3 will be permitted to register as one of Mysten Labs’ Active Contributors & Early Supporters (ACES) members. Users who register by May 17 at 11 a.m. PDT will be eligible for the programme and receive an exclusive NFT.

Fusionist, a blockchain gaming and infrastructure layer, confirms rumours of an ACE token airdrop to reward early backers and testers.

As market players take a break from the previous weeks’ euphoric memecoin trading, the market grinds lower. Keep checking back for next week’s edition and keep funding your preferred causes, degens!